CREATIVITY IS our CURRICULUM.

Almost 5 years ago a group of community stakeholders including teachers, staff, and parents met to discuss their dreams and plan for the future of St. Laurentius School. One of the dreams was to establish a creative arts program for future generations of students to grow in art, music, and dance.

As we turn our attention to the development of our Creative Arts program, we’re envisioning studios that will be filled with fine and visual arts, opportunities for videography and photography, digital media, dance, culinary arts, and more! This will be a space to cultivate the next generation of creative learners, thinkers, and problem solvers. In fact, St. Laurentius School is the only Catholic School within Philadelphia dedicated to providing elementary students with a creative arts education.

Our dreams for the students of St. Laurentius School are coming to fruition. Renovations are currently underway to transform the St. Laurentius Church rectory into a brand new Creative Arts Center. We are humbly asking for your support to provide more opportunities for our students to enjoy the performing arts.

EITC Giving

We believe every school-aged child in the Philadelphia region – regardless of race or religion deserves a future filled with promise + hope. Through the establishment of Educational Improvement Tax Credit (EITC) and Opportunity

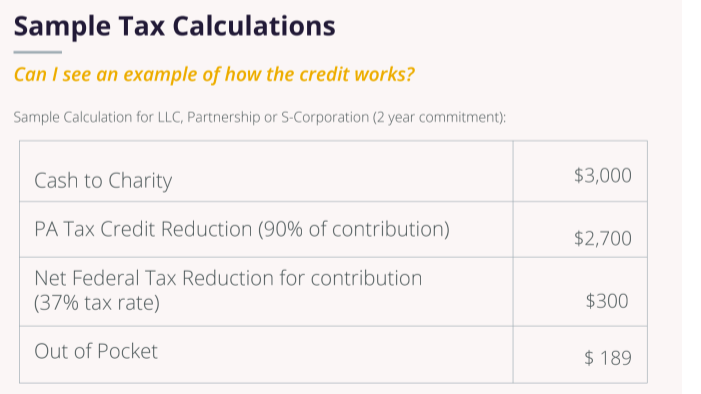

Scholarship Tax Credit (OSTC) programs, donors can receive up to a 90% tax credit against their personal PA state tax liability by making their gift through BLOCS. An individual or company who wish to take advantage of this tax credit program may become a member of a BLOCS Scholarship LLC (“LLC”). These special purpose entities (or SPE’s), are the only financial vehicle available for individuals (or companies who do not have direct tax credit approval) to be able to realize tax credits in return for scholarship donations.

To join, an individual or company makes a 2-year commitment, (minimum of $5,000 per year), to fund the LLC. Once approved by the state, BLOCS has 60 days to fund the LLC, meaning your first payment of two will be required within that time period. Your second (or Year 2) contribution will be made approximately one year following the first payment date.

The LLC will then receive tax credits equal to 90% of the donation amount. These credits will be distributed to each member via K-1 and are then applied to your PA tax liability for the tax year in which the donation is made.